non filing of tax return meaning

This amount has to be paid for each day until total fine becomes equal to the TDS amount. Only certain taxpayers are eligible.

A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules.

. E-filing of Income-tax return is filing your Income-tax return online There are two ways to file an Income-tax return in India. Having employees may also require the S corporation to file an annual Federal Unemployment Tax Return each year on Form 940. This may include tax avoidance which is tax reduction by legal means and tax evasion which is the criminal non-payment of tax liabilities.

Amendments may be necessary to allow the individual to be credited through an income tax and benefit return. TaxActs support team offers all the tax and product support you need. If the corporation pays wages of 1500 or more in any calendar quarter or has at least one employee working at least part of a day in 20 or more separate weeks it typically needs to file.

Capital Gains and Losses - Transaction Adjustment Codes. If the deductor fails to furnish the TDS return on or before specified due date he shall be liable to pay a penalty of 200 per day till the date of default. For non-filing of TDS Returns.

The penalty under 271H In addition to fees to be paid under 234E AO may charge the penalty of minimum Rs. Annual filers will file a single tax return and make one payment for all sales and use tax collected each year due on January 31 of the following year. They should report their income as business income on an income tax and benefit return along with a statement of revenue and expenses.

The other one is the electronic mode where you can submit your return online through the income tax website or by following. A T4 slip should be cancelled if it is issued to a proprietor or partner in an unincorporated business. Late Filing Fees under section 234E a fine of Rs.

The return and payment for the July 2022 tax period is due August 31 2022. If you have receive a demand notice from Income Tax Department then click on Demand Payment option for TDS on property. The discussion can be sub categorized in two parts-.

Click on Form 26QB. IRS Letter 12C - Reconciliation of Premium Tax Credit Payments. Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section 62-12 qualified by Code sections 9523 f and g and are not otherwise exempt under Code sections 954 2105 and 2805 unless their combined taxable gross receipts in the City.

If married the spouse must also have been a US. For late-filing of TDS Returns. Filing a Federal Individual Tax Return Extension - Form 4868.

200 per day is to be paid until the return is filed. The tax shall be collected at source TCS on higher of the following. Tax noncompliance informally tax avoision is a range of activities that are unfavorable to a governments tax system.

MCA department has issued circular no. B Type of Payment. Get answers to your tax questions by browsing through our most popular tax help topics.

2 times the rate given in the Income Tax Act or Finance Act or. 10000 and maximum Rs. Filipinos living in the Philippines and earning income from sources within andor outside the country including the following.

Its most general use describes non. The use of the term noncompliance is used differently by different authors. The status of seller is irrelevant.

Important Details about Free Filing for Simple Tax Returns If you have a simple tax return you can file with TurboTax Free Edition TurboTax Live Basic or TurboTax Live Full Service Basic. The tool is designed for taxpayers who were US. Basic information to help you determine your gross income.

If you havent filed a tax return for tax year 2017 and had any money withheld from your paychecks or are eligible for tax credits you need to file by May 17 2021. Unemployment tax filing date. If you were required to file ITR or if not required as above the tax department still asks you file us 1421But you fail to do so.

Employees with two or more employers whether at the same time or successively at any time within the. Youre required by law to file returns and pay taxes if you belong to any of these taxpayer categories. Offline in paper format where the return is submitted physically to the IT department.

Latest Update in Form AOC 4. In January 2023 you will file a single tax return for all sales and use taxes collected in 2022. 16 regarding due date.

Federal income tax withheld. 122 Individuals including non-resident individuals registered for tax with. Citizens or resident aliens for the entire tax year for which theyre inquiring.

Citizen or resident alien for the entire tax year. An original return claiming a refund must generally be filed within three years of its due date. Please note that the total amount of such penalty cannot exceed the total amount of tax deducted at source.

One is the traditional method ie. The department of MCA has released circular number 222021 notifying regarding extension of due dates for filing annual return forms AOC-4 AOC-4 CFS AOC-4 XBRL AOC-4 Non-XBRL till 15th February 2022Read more. If you are filing a return and one of the parties is deceased or one of the parties is.

Form is having various section as follows-a Tax Applicable Select Corporation tax if the purchaser is a Company otherwise Income Tax. If you dont file your ITR because your income does not exceed Rs25 lakhsThen nothing happens normally. 121 Meaning of PPS number Your Personal Public Service Number PPS number is a unique reference number.

In addition to non-filing of income tax return if the specified person does not give their PAN then tax shall be collected at 20 or rates applicable as per the section whichever is higher. Then many repercussions as described below may follow. When filing the.

Filing Corporation Nil Tax Return How To File A Nil Return Taxation Blog

How To Register On The Income Tax Website And File Returns Income Tax Income Tax Return Filing Taxes

How To Fill Out A Fafsa Without A Tax Return H R Block

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Do Nris Need To Disclose Foreign Account Details In Tax Returns Sbnri

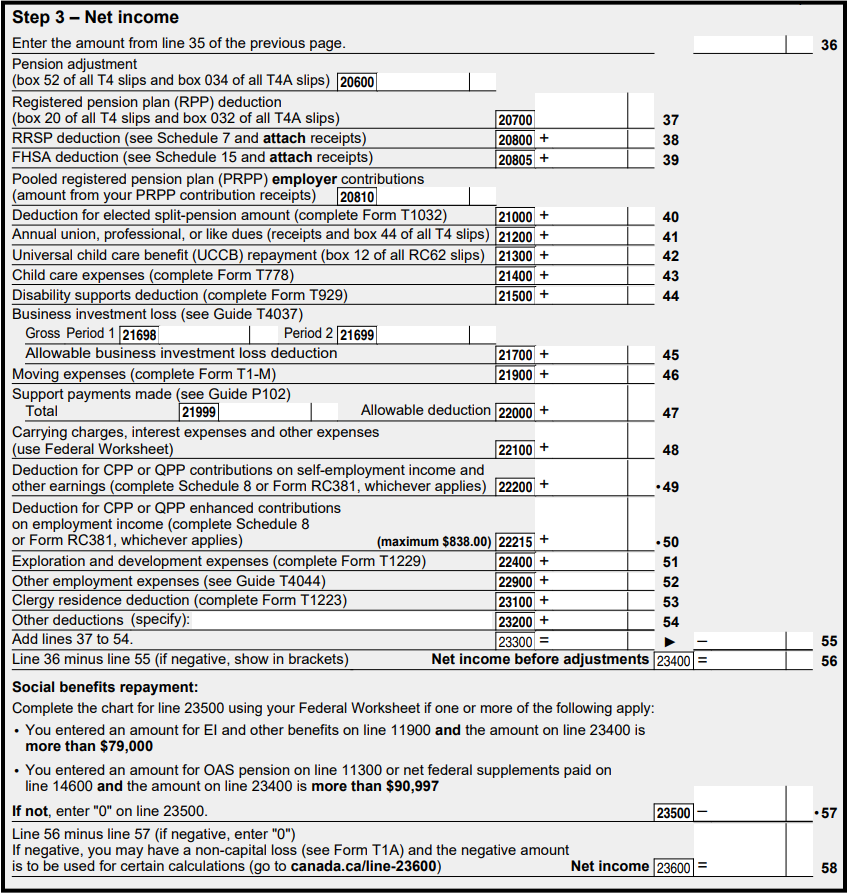

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Here S Why Your Tax Return May Be Flagged By The Irs

Do You Know About Annual What Is Annual Return Gstr 9 Know About The Due Date Eligibility Filing Format And The Penalty Levied Due Date Meant To Be Dating

Definition What Is A Tax Return Tax Return Tax Tax Services

What To Do If You Receive A Missing Tax Return Notice From The Irs

What Is A 1120 Tax Form Facts And Filing Tips For Small Businesses

Who Should File Income Tax Return In Canada Consolidated Canada

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

:max_bytes(150000):strip_icc()/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

The Ultimate Guide To Doing Your Taxes

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Common Usa Tax Forms Explained How To Enter Them On Your Canadian Tax Return 2022 Turbotax Canada Tips

/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)